Consumers and a Growing Interest in Gaming

The gaming industry is in the midst of a transition towards greater multiplatform play and greater dependence on recurring subscription service revenue. The increasingly mobile connected consumer fuels the momentum behind mobile gaming. Consumer interest in multiplayer gaming, particularly on PC and gaming consoles, continues to be healthy. Game industry competitors are investing in growing their services revenue as consumers find subscription access to multiplayer capabilities, game libraries, or cloud gaming increasingly appealing or even indispensable. The COVID-19 pandemic may have accelerated these trends as consumers had more time and opportunity to game. In fact, consumers in US broadband households reported gaming an average of 16 hours per week in 2020, up from just 12 hours per week prior to the pandemic.

2022 is the year to watch for the industry due to the renewed momentum behind a newer trend that stands to shape the industry over time. Microsoft’s major push behind new Xbox Cloud Gaming partnerships and hardware, integration of Xbox Cloud Gaming into Windows 11 via the preinstalled Xbox app, and Google’s launch of Stadia across the Android TV / Google TV landscape, all in 2021, are signals from major ecosystem players that cloud gaming is here to stay despite initial hurdles. It remains to be seen how significantly cloud gaming services will drive engagement on non-traditional gaming devices such as smart TVs and streaming media players, but cloud gaming’s place on consumers’ list of gaming options is now seemingly assured.

Though traditionally popular platforms for gaming, namely PCs, consoles, and more recently mobile devices, will continue to be heavily utilized by gaming consumers, cloud gaming is a complementary change agent that raises the level of gaming experience possible on mobile devices and non-traditional platforms. The now-realistic prospect of enabling access to higher-quality gaming for more consumers, across more devices, and without the traditional investment in additional hardware, is a potential growth driver for the gaming market over the next five years.

Platforms Used for Gaming

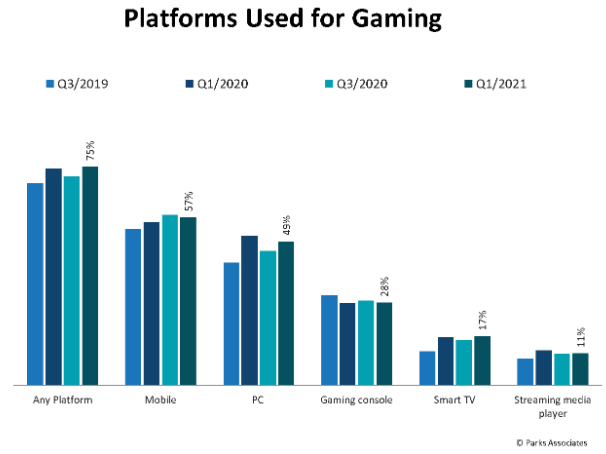

75% of US broadband households game; mobile devices and PCs are preferred. Gaming is increasingly common in modern society, and mobile devices and PCs are the two most-preferred platforms for gaming, with consoles not far behind. Both platforms experienced growth in gaming during the pandemic. While smart TVs and streaming media players (SMPs) both saw increased gaming usage over the same period, smart TVs experienced a larger increase. Mobile devices are the most popular gaming platform and growing; now used for gaming by 57% of broadband households, up from 53% in Q3 2019.

Gaming continues to trend slowly upward as a staple of modern society, with gaming now taking place within 75% of US broadband households. Among those who are playing games, mobile devices and PCs are the two most-preferred platforms to game on.

Convenience, the mobile nature of the modern consumer, an increase in hardware capabilities of smartphones and tablets, and ever-improving mobile broadband performance, have all contributed to mobile’s rise as the top gaming platform. PCs’ ubiquity, broad utility, and suitability to the popular multiplayer gaming genre, are enduring reasons for the platform’s greater popularity compared to single-purpose consoles and comparatively low-powered smart TVs and streaming devices.

This is an excerpt from Parks Associates consumer study: Next-Generation Gaming: Consoles and Cloud. This research examines consumer interest in the latest generation consoles and in cloud gaming services, and identifies key consumer groups that must be targeted to best capitalize on the opportunity that each of these two new sets of gaming capabilities present.

Key questions addressed:

- What devices are consumers preferring to play games on, and how is this evolving?

- How has the pandemic affected the use of smart TVs and streaming devices for gaming?

- What is the current state of the US market for dedicated gaming hardware such as gaming consoles, gaming PCs, and VR headsets?

- What is the current level of consumer interest in cloud gaming?

- What market segments should cloud gaming services target?

Next: Netflix Considers Strategies to Counteract Subscriber Loss

Previous: Reaching Today's Video Audiences - Streaming Video Products in the Home

Comments

-

Be the first to leave a comment.

Post a Comment

Have a comment? Login or create an account to start a discussion.