Online Pay-TV Households More Dynamic in Their Subscription Behaviors

The pay-TV landscape in the US has gone through dramatic changes in the past several years. Traditional pay-TV services, via cable, satellite or telco operators, face a future where consumers have a wide variety of options for video content combined with direct competition from an array of online pay-TV service providers. These online providers provide a subset of channels, targeting the entertainment content subscribers want to watch, typically at much lower prices. As a result, pay-TV subscription behaviors for traditional and online services have significantly changed.

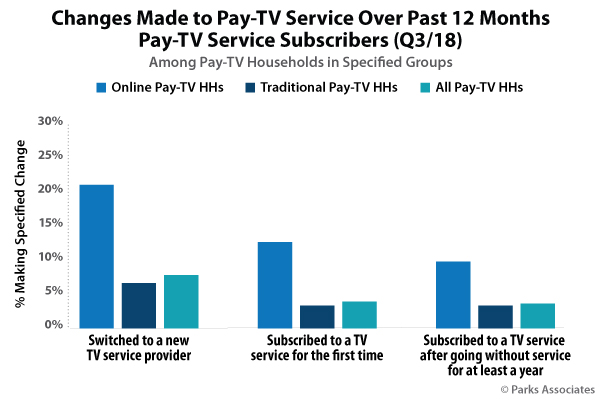

Recent research from Parks Associates shows that among all pay-TV households, subscribers are more likely to downgrade their existing service than switch to a new service, upgrade their existing service, or subscribe to a service for the first time. When splitting out pay-TV households into traditional and online subscribers, dynamic patterns among the online group emerge. More than one in five online pay-TV households—which represent 12% of all broadband households—have switched providers in the past year. More than one in ten have subscribed to a service for the first time, and nearly one in ten have re-subscribed to a service after a year or more without a subscription.

Established and emerging players alike are attempting to conquer subscriber churn and service downgrades head-on by developing or reconfiguring their online offerings. Some traditional pay-TV operators are countering this threat to their share and the dynamic subscription patterns of their viewers by offering online pay-TV services of their own. Dish Network’s Sling TV, Charter’s Spectrum Choice, and Comcast’s Xfiniti Instant TV are just a handful of examples where legacy providers are attempting to compete for elusive TV subscribers who have downgraded their traditional service, canceled service, or have never subscribed to traditional pay-TV in the first place.

Recent developments demonstrate the dynamic nature of the online pay-TV space. For example, AT&T just announced sweeping changes to its online pay-TV offering DIRECTV Now. The pricing and content changes are meant to increase profitability by pushing up monthly subscriber fees and streamlining bundles to reduce carriage costs, while also increasing the presence of recently-acquired Time Warner assets such as HBO. Another example is Disney, now majority owner of Hulu as a result of its just-completed acquisition of 21st Century Fox. This sale puts Disney in a very unique position in the online pay-TV ecosystem—the company is a content partner to many online pay-TV providers, as well as a direct competitor to those same providers with its own Hulu with Live TV service.

As the dynamic behaviors of online pay-TV subscribers demonstrate, both established and emerging players in this space will be at risk to lose subscribers to other services at an accelerated rate if their viewer’s needs are not met. On an ongoing basis, providers must re-evaluate and re-tool their online pay-TV offerings to reduce subscriber churn and stay relevant in an ever-increasingly competitive and fragmented market.

For a deeper look at traditional and online pay-TV, TV antenna adoption, and video device ownership and usage, please check out Parks Associates' latest 360 View: Entertainment Services in the US.

Further Reading:

- TV & OTT: Consumer Demand for Original Content

- Consumers are far more likely to recommend online pay-TV than traditional pay-TV services

- Video’s Critical Path: Success at Web Speeds

Next: Three Thoughts from Apple’s Video Announcements – 3.25.19

Previous: OTT Platform Availability: Expectations vs. Reality

Comments

-

Be the first to leave a comment.

Post a Comment

Have a comment? Login or create an account to start a discussion.