The Disruption of DIY in Residential Security

The traditional residential security channel is dominated by professionally installed, professionally monitored systems. The market is highly fragmented with relatively few national players, regional dealers occupy the mid-market and approximately 13,000-15,000 local independent dealers constitute the balance of the market. DIY security solutions have the potential to impact this portion of the market in the longer term, as self-installed systems offer monitoring services at lower prices than professionally installed systems. Lower priced monitoring fee alternatives make segments of this market vulnerable to erosion by self-installed systems. Similarly, self-installed systems have the potential to reduce acquisition costs by eliminating installation cost and replacing it with less expensive support services.

Newly introduced self-install security solutions are designed from the ground up to be installed by the consumer. These solutions seek to expand the market to households unmoved by traditional self-installed security systems that use traditional security panels and sensors (roughly 70%). Additionally, DIY smart home devices such as networked cameras are competing with DIY security systems to provide peace-of-mind to consumers who do not have or will not acquire a security system.

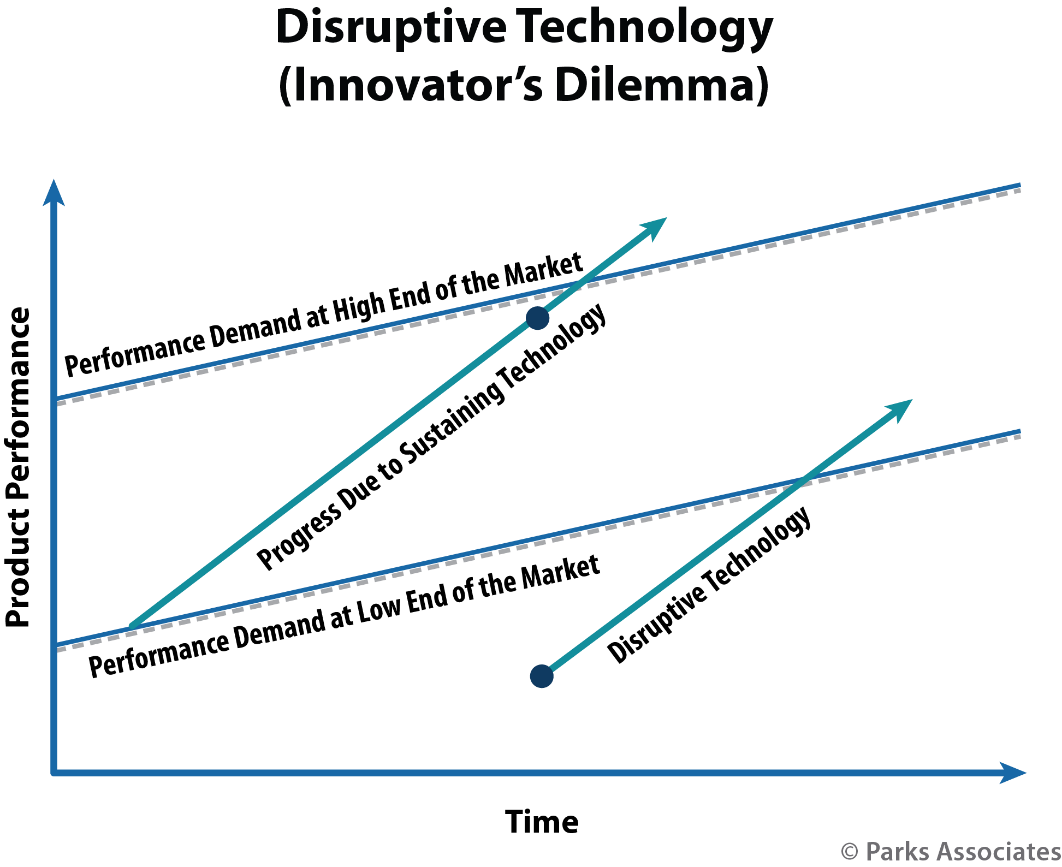

Disruption, according to Clayton Christensen’s Innovator’s Dilemma, comes from low-cost substitutes that under-perform in relation to the needs of the market. From the security industry perspective, smart products and DIY systems are woefully inadequate substitutes for a security system. From a consumer perspective, smart products and DIY systems make them feel safe and provide peace-of-mind, and for the price, the shortcomings of these products presented by the pro-install industry fall behind.

Recent data from Parks Associates’ survey of 10,000 households includes:

- 28% of US broadband households have at least one smart home device, nearly tripling from 9% in 2014.

- 46% of self-installers state that keeping their home safe was a main purchase driver for the purchase of their security system.

- Only 14% of self-installed system owners report that their system came from a security dealer; the majority cite their system is from an online or national/local retailer.

For more information on DIY security, Parks Associates’ DIY Disruption: Smart Products and Home Security and DIY Home Security Tracker assesses the DIY home security market, the appeal of DIY, consumer preferences and behavior.

Further Reading:

- 36% of those intending to purchase a security system prefer self-installation

- Market Snapshot: DIY and Home Security

- Home Security: Market Sizing and Forecasts

Next: Drivers and Inhibitors for Purchasing Smart Home Products

Previous: Biggest Challenges Releasing New Smart Home Products and Services in Europe - Insights By Verimatrix

Comments

-

Be the first to leave a comment.

Post a Comment

Have a comment? Login or create an account to start a discussion.