Video Survival vs. Success: Operating at Web Speeds

OTT video has reshaped a successful industry. What must operators do to recapture their position as primary providers of video services?

Change can be sneaky, particularly when it comes to consumer products and services. Some technologies enter the market with great fanfare only to quietly fade away a few years later. Others go from interesting novelties to behavior-changing products almost before consumers realize what has happened. The smartphone is a great example. Prior to 2006, few could have foreseen that a calculator-sized device would so significantly impact the way we communicate, socialize, follow news, find information, and experience entertainment. So much so that some consumers would panic if their smartphone is out of their sight, or pocket, for more than a few minutes.

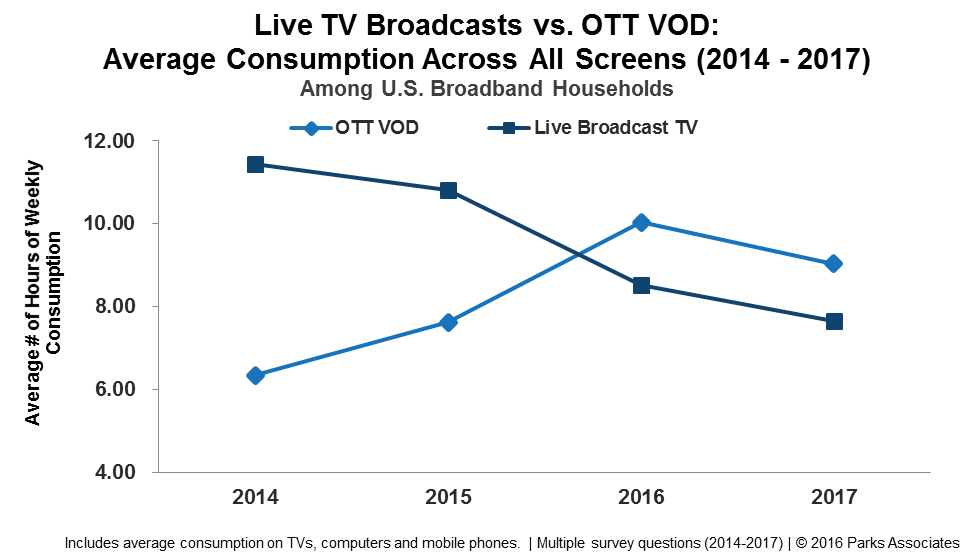

OTT video services are producing the same level of change, both in consumer habits and in the entertainment industry overall. Live broadcast TV represented over 60% of consumption on a television in early 2012 but only 44% by the end of 2017. VOD-oriented OTT video services were a big part of that shift, surpassing broadcast TV consumption across all screens in late 2015 (Figure 1).

Figure 1: The Shift in Video Consumption

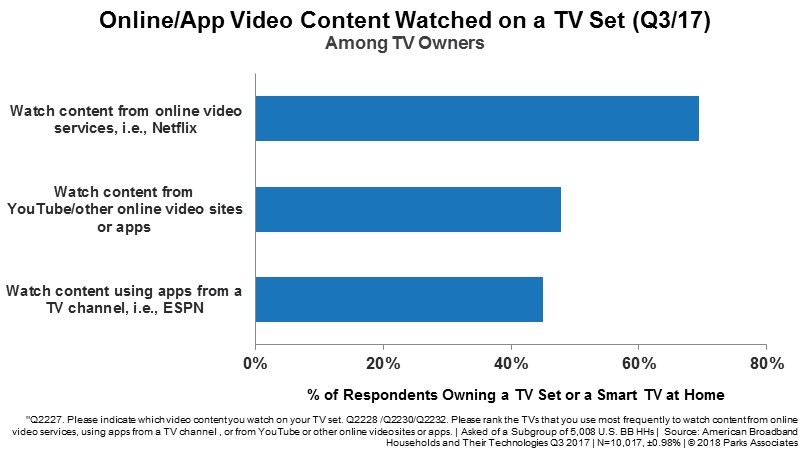

Today, consumers are more likely to use an online video service app than a network TV app to watch content on a connected TV (Figure 2).

Figure 2: App Use on Connected Televisions

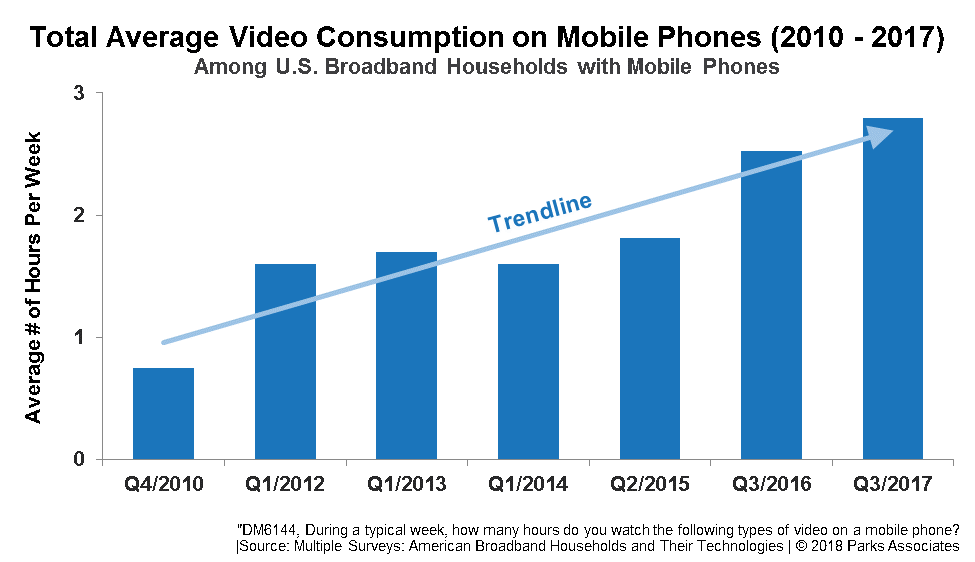

The impact has been even more profound in the mobile marketplace. Consumption of video on mobile phones has skyrocketed, particularly in the past three years, jumping by over 55% between 2015 and 2017 (Figure 3). Several mobile carriers have added video and features to their mobile data plans, and video consumption is a leading factor driving smartphone design.

Figure 3: The Increase in Video Consumption on Mobile Phones

The Business Impact

The seismic shift in consumption has resonated across global markets. Beyond the sheer volume of video data now being transmitted across copper, fiber, and wireless networks, OTT video has driven several other changes in the ways operators must address their video business:

- New customer expectations. The standard for comparison has changed. Consumers now assess the user experience and value proposition for all video services, including pay TV, based on their experiences with web or app-based video services. Consumers expect a highly personalized service that knows them, is easy to use, and is available on any device that they want to use. OTT video services have invested heavily in personalization technologies for an enhanced user experience that minimizes the time between service access and first video watched, a key KPI. OTT video services also provide a common experience across devices and markets, offering a unique experience regardless of where consumers want to access content.

- New ways that consumers select and purchase services. While multi-play bundling remains an important strategy, consumers cannot easily find bundles that fully address their needs. Today’s consumers self-aggregate video services, starting with the content and service they most want and then supplementing that service with others in the marketplace. Trials are an important part of the evaluation process for video services, allowing consumers to try a service before opting in, an advantage for web-based offerings and a challenge for managed network services.

- Fast-moving, dynamic marketplaces. While pay-TV players often have the same direct competitors for decades, OTT video competition is constantly changing. Each month, new services become available, competing for viewers’ attention. Over 200 services are available in the U.S. market alone. Each European market often has 80-100 OTT video competitors, in addition to offerings from traditional pay-TV providers or mobile carriers. OTT video services are quickly emerging throughout Asia as well. Each OTT service offers new points of differentiation and constantly iterates its service in order to remain relevant. Because these players rely on cloud-based platforms and technologies, they are highly adaptable, able to quickly propagate feature and interface improvements across all markets overnight.

- Changes in monetization. Adaptability in service features is coupled with flexibility in business models. The high competition in OTT video has caused many players to iterate their service over time based on opportunities, business needs, and consumer interest. While subscriptions remain popular with consumers, ad-based or blended ad/subscription models have become increasingly common, particularly in markets where a handful of subscription services are dominant. Unlike subscriptions, advertising revenues scale with viewership. They also are popular with advertisers eager to target young or difficult-to-reach demographics.

- Global competition. While pay-TV providers often focus on their own network footprint, competition is now a worldwide affair. Netflix, Amazon, iFlix, and other global players have raised the stakes for OTT video from local to global competition. Today, OTT video services are designed with global expansion in mind, and are able to quickly deploy on a worldwide basis with the help of a CDN partner. OTT players design their apps, infrastructure, and interfaces to operate across worldwide markets and on the devices popular in each region. They are able to offset content and technology investments by spreading the costs across multiple global markets.

- A new focus on retention. With higher overall churn, OTT video services leverage new approaches and tools to address retention. While original content is an important part of its retention (and differentiation) strategy, Netflix maintains significantly lower subscriber churn than other services through its personalization and user experience. It focuses on quickly surfacing content to consumers in order to keep viewing times high, even optimizing the images displayed in the user interface to increase viewership. By doing so, Netflix is able to regularly validate their value to consumers. Netflix also leverages big data analysis, enabling them to quickly identify at-risk customers. Other OTT video services facilitate user communities, allowing fans of particular content to interact with similar fans, and promoting events or interaction that will be popular with those communities. They also use bundling, cross-selling, or partnerships to positively impact churn.

Addressing the Changes

Many traditional pay-TV providers are aggressively addressing this new environment. Yet, change does not come easily, particularly for companies that have delivered high quality video services in much the same way for many years. The scale of disruption in the video industry requires traditional pay-TV providers to address things in a new way:

- A new mindset about video services. Operators that rely exclusively on video services through their managed network will be left behind. AT&T, Sky, Orange, and other operators have launched their own online offerings in order to stay ahead of the market. The service bundle must also evolve. Data remains a critical component. Operators will increasingly bundle OTT services with broadband, providing an advantage over pure-play OTT services. The mobile bundle must expand beyond data, with mobile video serving as a differentiator and incremental revenue generator. In addition, OTT consumers seek a branded OTT VOD experience beyond live TV, making new bundles of separate live and on-demand OTT services compelling.

- A new approach to development. Operators must embrace ongoing innovation in order to be perceived as cutting-edge. They need to adopt the rapid development and deployment of the web-focused players, either in their own development teams or in their vendor relationships. Development cycles need to be short and directed by data on consumer habits and feedback.

- A new priority in service delivery. Operators will need to have the flexibility and adaptability of OTT video services in order to remain relevant. Those unable to be flexible in their business approach, service design, and marketing will continue to be outflanked by services that are better able to meet consumers’ needs. Operators must also be able to offer new features to remain at parity or better than OTT services or direct competitors.

- A new perspective on competition. Operators will be competing in a global marketplace of video services, presenting a challenge in terms of local competition but an opportunity for market expansion. Those services that are able to regularly prove and reinforce their value to consumers will be able to retain them over time. Personalization will also be critical, particularly when it makes consumers feel known and valued.

Further Reading:

- Market Snapshot - OTT and Pay TV: Partnerships and Competition

- Consumers watch more than two hours of alternative video on a computer each week

- OTT Video & TV Everywhere: Partners, Alternatives, and Competition

Next: AT&T - Assembling the Pieces for Success in Digital Advertising

Previous: How Esports are Changing the Game

Comments

-

Be the first to leave a comment.

Post a Comment

Have a comment? Login or create an account to start a discussion.