Growing Demand for Streaming Media Players: Amazon's Share Increases by 4%

OTT video is firmly established in the U.S. entertainment marketplace—more than two-thirds of U.S. broadband households have an OTT service—and the popularity of this service translates into hardware sales and usage. At first, connected gaming consoles were a leading connected entertainment platform, but as the market evolved, the race for to capture consumers’ video viewing is now between two device categories: smart TVs and streaming media players (SMPs).

Many industry observers expected SMPs to fade as adoption of smart TVs increased, since the two devices both essentially serve the same function in connected consumers with online content, while smart TVs have the obvious advantage of having a screen. But ownership of streaming media players has continued to rise, even as adoption of smart TVs has reached nearly 50% of U.S. broadband households. Parks Associates has tracked adoption of SMPs from about 6% of U.S. broadband households in 2010 to almost 40% today.

SMPs have proven resilient due to their use of modern and friendly user interfaces (which are quick to adjust to user preferences and feedback), ease of use, broad app support, and low costs, which make them easier to upgrade and replace than a television set. They also benefit from strong usability scores, with Roku, Apple TV, and Amazon’s Fire TV leading the way. Roku, the leader in share of installed base, leads in multiple usability categories, but Amazon’s Fire TV has moved up to second place in the ease-of-setup category and is close to the Apple TV’s score in several more, including ease of finding something to watch and ease of purchasing content.

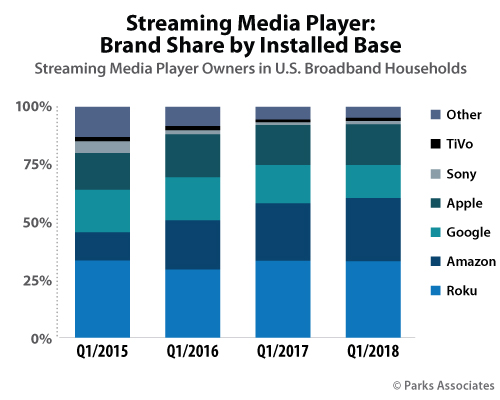

Parks Associates’ consumer data indicates that Amazon’s share of streaming media players owned in U.S. broadband households has increased by 4% since last year, or ~17% year-over-year (YoY), taking some of Google’s share of the installed base, while Roku’s share has held steady at 37% for the past year. These are consumer-reported figures of share of the current installed base of these devices – that is, the share of all devices owned – which include devices that may have been purchased several years ago, but they are the early indicators what could be a significant shift in the market, as Amazon has experienced dramatic growth in the past year alone.

Parks Associates' Digital Living Forecast: Streaming Media Players estimates that in the United States, between 2016 and 2017, Amazon's Fire TV unit sales increased by 67% - rocketing it from 38% of U.S. streaming media player unit sales to 47% of unit sales. Both 2016 and 2017 were blockbuster years for the Fire TV.

How did Amazon accomplish this? Over the past several years, Amazon’s share of the streaming media player market has grown rapidly due to its aggressive pricing strategies and its strong core eCommerce platform. In addition to its aggressive pricing and high visibility on the Amazon eCommerce platform, the Fire TV incorporates many of attractive features:

- 4K Ultra HD and HDR support

- Voice search across 190 channels and apps

- Personalized content recommendations on the home screen

- Single sign-on—allowing pay-TV subscribers to sign in with their pay-TV credentials once

- Voice control via a bundled remote control and via Amazon’s popular Echo smart

- Integration with the Alexa digital assistant platform, enabling Fire TVs to act as an Alexa control device for connected smart home products.

-

Ability to show security video feed from its own Amazon Cloud Cam and compatible devices

It also benefits Amazon to have the second most commonly used OTT video service in the U.S., after Netflix.

Amazon’s current success highlights the need for streaming media player makers to continue to innovate and offer new features, not only to differentiate themselves from smart TVs but also from other SMP competitors. Amazon is leading the way in this new phase of SMP development, but its competitors are starting to respond. For example, Roku launched its new Roku Channel in September 2017 in an attempt to break into content and has plans to launch its own digital assistant ecosystem, called the Roku Entertainment Assistant, by late 2018.

Continued innovations will be necessary as consumers continue to move away linear video viewing, and their spending will follow their viewing habits.

Further Reading:

- Smart TVs vs. Streaming Media Players: Winning Over Consumers

- Entertainment Device Controls: Refining the Ideal UX

- Market Snapshot - Smart TVs & the User Experience

Next: Roku Brings Audio to their Home Entertainment Network

Previous: Preliminary Agenda for Integrated Life Program

Comments

-

Be the first to leave a comment.

Post a Comment

Have a comment? Login or create an account to start a discussion.