Price Hikes Mean Uncertain Future for vMVPDs

vMVPDs, online pay-TV services that offer bundles of live channels, entered the video services market in 2015 with a promise of lower monthly costs and more customizable channel packages than traditional pay-TV, and no restrictive contracts. The goal was to capture dissatisfied traditional pay-TV subscribers and those interested in an online live/linear TV experience. vMVPDs largely delivered on that promise by building a solid base of subscribers across several different providers, like Sling TV, YouTubeTV, and Hulu with Live TV. However, recent trends are cause for major concern for vMVPDs.

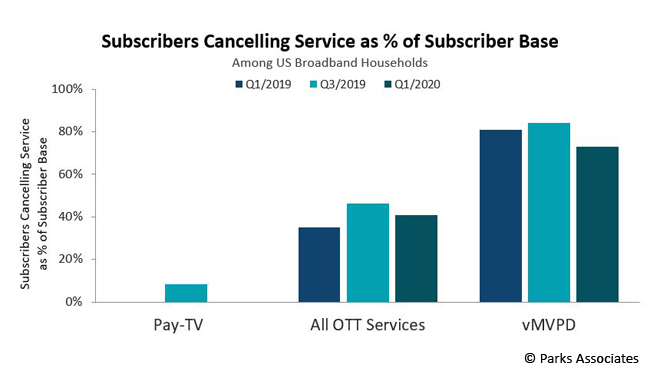

While overall OTT subscription uptake has seen a significant increase recently, vMVPDs have experienced relatively slow growth. Besides a stagnant uptake rate, vMVPDs have also suffered from an issue that plagues all paid video services—customer churn. Due to the higher cost than standalone OTT services, the relative uniformity of offerings across providers, and the lack of contracts, churn among vMVPDs is considerably higher than the average OTT churn rate. While the rate dropped some during Q1 2020, overall churn rates for vMVPDs continue to exceed 70%.

Beyond the stagnant uptake and sky-high churn, recent developments in the vMVPD space may signal an even more uncertain future. In late June, YouTube TV announced a whopping 30% increase in its monthly price. The rate increase corresponds with the addition of several channels from ViacomCBS and follows similar increases YouTube TV imposed as it added channels from other content providers. At the time of the announcement, the service acknowledged the challenges in raising prices during a pandemic but cited the “rising cost of content” for the action.

The YouTube TV situation highlights a major challenge that pay-TV services face as they try to grow their revenue and subscriber base. These services must rely on content providers for their channel offerings via high-priced carriage agreements. The only viable way for vMVPDs to effectively absorb these sky-high carriage fees is to pass along the cost through price increases to subscribers.

Shortly after the YouTube TV announcement, fellow vMVPD fuboTV also revealed a price increase. The pricing announcements coincided with the long-anticipated additions of Disney-owned channels such as ESPN, Disney Channel, ABC, and National Geographic. Once again, vMVPDs, because of the restricted parameters of the pay-TV business model, have to pass on content distribution costs to subscribers in the form of higher subscription rates.

In response to the YouTube TV and fuboTV announcements, other vMVPDs announced measures to attempt to stave off further subscriber erosion. Sling TV, which has experienced its first subscriber losses in recent quarters since its inception in 2015, is providing subscribers a 1-year hold on their monthly subscription price. Low-cost vMVPD Philo also announced that it would hold its subscription price, though the length of the price hold was not revealed.

vMVPDs have attempted to occupy the space between traditional pay-TV services and standalone subscription-based OTT services. The relatively low monthly price was once a significant differentiator for these services. However, with the ever-escalating costs of carriage agreements, monthly prices for channel packages are quickly approaching the levels of traditional pay-TV. Unless something drastic happens in the vMVPD space, such as the complete reconfiguration of its business model, the long-term viability of these services will continue to be in question.

For a deeper look at the OTT video space, please check out Parks Associates’ OTT Tracker and the Quantified Consumer report Consumer Perception of OTT Video.

Comments

-

Be the first to leave a comment.

Post a Comment

Have a comment? Login or create an account to start a discussion.