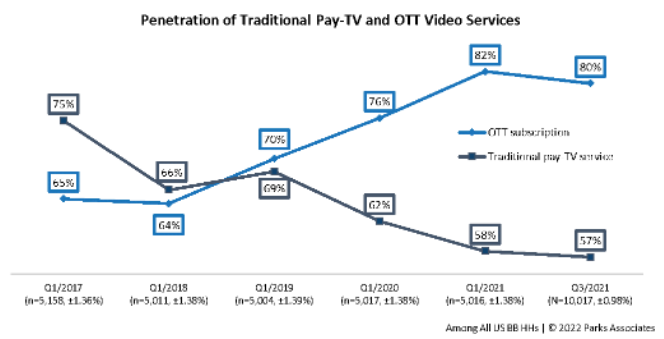

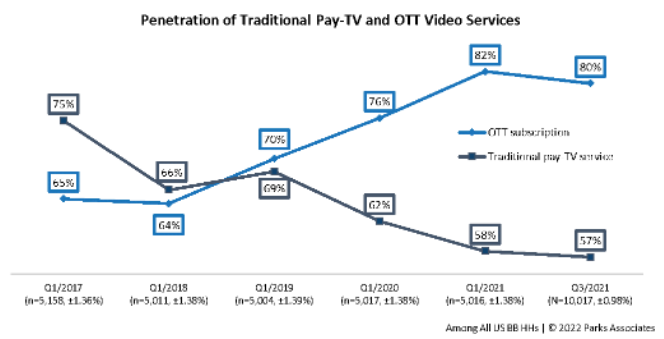

OTT services experienced significant growth during the height of the COVID-19 pandemic. In Q3 2021, 80% of US internet households reported subscribing to at least one OTT service. Meanwhile, just 57% said they subscribed to a traditional pay-tv service, continuing the long, steady decline that began more than five years ago.

Initially, direct-to-consumer services were offered by providers like Netflix, founded in 1997. But now, consumers have more options. In fact, the percentage of households subscribing directly via an OTT provider’s website declined from 41% to 29% between Q1 2020 and Q3 2021.

OTT aggregators such as Amazon Prime Video Channels, The Roku Channel, and Apple TV Channels offer indirect paths to subscription. They provide service partners with a high-profile access point to showcase their offerings to prospective customers as well as marketing and billing support. At the same time, they provide end users with a unified platform to subscribe to and view multiple services. Even with those benefits, there is a push and pull between aggregators and some service providers who want to maintain the subscription revenue and full rights to valuable user data.

Some content providers are seeking to re-establish control over their viewers—and the data about them—by not offering subscriptions via aggregators. HBO and HBO Max, for example, were removed from Amazon Prime Video Channels in September 2021. John Stankey, CEO of HBO parent company AT&T, explained the move, saying “Better to have (customers) where you have direct access control of them, can market to them, know what they’re doing than to have it be in some black box where you absolutely have no idea what somebody else is doing with aggregating your content and your exposure to the customer.”

Likewise, Disney+ is not available through major aggregators. Direct subscriptions are appealing to OTT providers because they share neither revenue nor user data with the aggregator. It is a competitive market and providers are looking for ways to reach consumers directly, but also find new ways to partner and differentiate through expanded reach to specific audience segments.

While these moves away from aggregators will have some short-term impact on subscriber numbers, loyal viewers are likely to seek out their desired content with a direct subscription, and the strategy makes sense for content providers who wish to maintain exclusive control over their relationship with their customers.

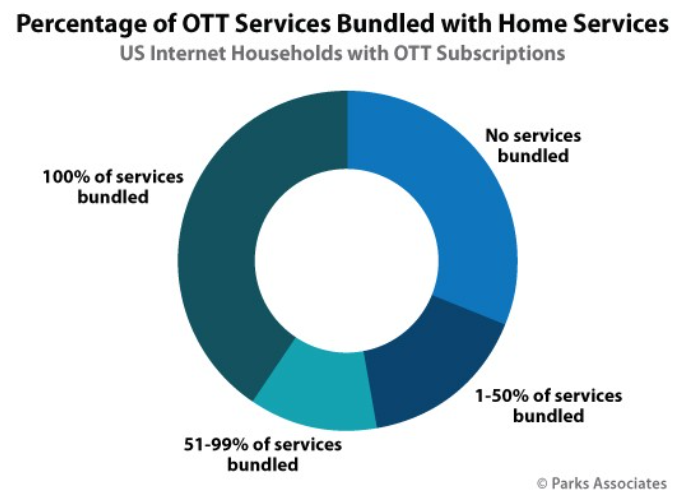

At the same time, simplicity has a fundamental appeal to consumers that service providers can leverage. Consumers are seeing value in receiving a bundle of channels and services from a single source, and they are increasingly seeking out options that offer OTT services bundled with their home services. Parks Associates research reveals that 59% of OTT subscribers reported that they prefer one bill and one account for all of their home subscription services, while 48% feel their home internet service provider adds more value when online video services subscriptions are offered.

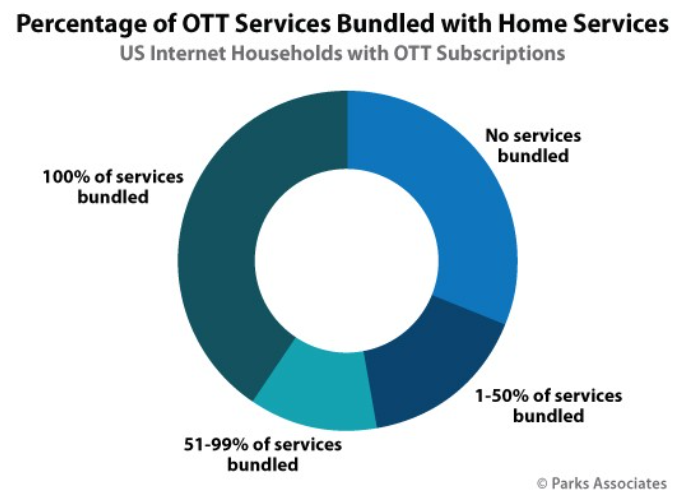

The study finds that 40% of OTT subscribers report that 100% of their OTT services are bundled through a home service provider. In contrast, just 31% of OTT subscribers report none of their services are bundled through a home service provider. While some of these consumers prefer to keep their video and home services separate, many are simply not aware of the availability of online video service bundled offerings. Word of mouth and recommendations through family and friends are the main avenues for households to discover these bundling options, so home service providers can increase adoption, especially among consumers ages 18-44, by encouraging current subscribers to discuss these offerings within their social circle.

There is considerable demand for OTT bundles from service providers for the added simplicity, value, and convenience that consumers feel they receive. Verizon’s newly announced Verizon Plus Play, in partnership with Netflix and other services, is an example of service providers serving these consumer demands for simplicity and convenience, via unified subscription management and billing for multiple OTT services.

The addition of OTT services to service providers’ subscription and bundled service offerings is a viable way to add value, increase long-term ARPU, reduce subscriber churn, and increase stickiness with consumers.

Next: Consultative Services for Smart Home Devices: Simplifying Complex Purchases

Previous: Unnamed